Project Description

Master Classes are deep dives into venture creation by MIT ecosystem thought leaders. Browse all Master Classes Here.

Joel Wishkovsky, founder of Simple Health, a company that provides birth control through online prescriptions, automatic refills, and free home delivery, gave a great talk to MIT in 2020 about the power of weekly emails to investors, advisors and employees. The following are pro-tips based on this talk by Dana Hwu (program manager for delta v NYC 2020), as well as a 2018 blog post on the same topic by Vivian Dai (program manager for delta v NYC 2018).

The power of a weekly update

The purpose of a weekly email is to keep advisors, investors and champions of your product up-to-date, excited and engaged. These emails are a way to build a community to support you, and they are a great place to include a call to action where you can ask your network for help, whether it is to get an expert opinion or to find leads for a key hire. You can also stay top of mind with potential investors.

If you include your own employees in the distribution list, the weekly email has the additional benefit of holding yourself accountable to your team and establishing and reinforcing alignment within your company.

Note that weekly emails are not a highlight reel – they are as transparent and honest as possible about the wins and struggles you are facing.

Make sure it’s something you would want to read yourself

People are busy. Make it succinct and not boring! Your message needs to be clear, the content should be interesting to read, and don’t include too many links. Updates like new sales, new customer engagement and new hires are all fair game. Be one of the first or last emails in their inboxes on Mondays – no one will read on a Friday.

Basic outline

- Main point is in the subject line of the email

- Short disclaimer in the beginning about not forwarding on to others

- Quick summary at the beginning if readers don’t finish the whole email

- Content:

- Monthly performance (use metrics, data analysis and what you’ve learned)

- Marketing update

- Product update (new features launching)

- Operations update

- Regulatory update

- Around the office (team culture, new hires, include photos)

- Asks

- User reviews/customer testimonials

Real life example showcasing best practices

Subject: Wkly – Beat Monthly Goals, Above $XXX/yr run rate

This is a weekly update that we do for existing investors and close friends. We’re writing for that audience, please do not forward.

TLDR

We had a very strong top of the funnel last week, ~XXX more installs than usual, with an above average conversion rate – however the performance of older cohorts are struggling. We did XXX orders and $XXX in sales, beating our prior week (and previous record) by XXX%.

August Performance:

Sales: $XXX (+XXX%)

Orders: XXX (+XXX%)

AOV: $XXX (+XXX%)

Product Margin: XXX% (+XXX bps)

Direct Margin: XXX% (+XXX bps)

Marketing:

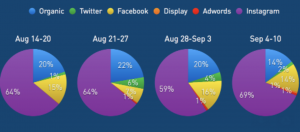

As you can see from the graph below, we’re finding scale on Instagram and Facebook ads and have profitable acquisition on almost every other channel we have tried:

Product:

Real time distance detection is live!

We are currently showing this to XXX% of patients. As we get more comfortable with its performance we’ll release it to the rest of the user base.

We’ve also hired an extremely talented designer [link their LinkedIn profile] who used to be at XXX. His work will also help inform color and UX treatment on other platforms.

Telemedicine Regulation Updates

We’re monitoring two telemedicine bills in New Jersey and Pennsylvania. Neither directly block us but both could unintentionally change our operating procedures. The one in New Jersey may actually unblock the state for us depending on how the Governor decides to line-item veto the bill.

Around The Office

We celebrated XXX’s birthday here in the office this week!

[insert picture of birthday party]

Asks:

- Intros to XXX and XXX. Anyone have a strong introduction for either of these companies?

- We need to get more involved as a key opinion leader across healthcare. Please send us events, panels, speaking engagements and opportunities to get involved.

Q&A

Q: Why is the weekly email so effective in keeping us connected with investors?

It is effective because it is a passive way to reach investors without constantly reaching out to see if they’re interested. There is a power structure problem: Investors have all the time and founders have no time to give. With a weekly email, it helps level he playing field by letting them know others are on the BCC.

In additionm your community can help solve your problems. Writing weekly emails develops the muscle of sharing your problems and asking for help. You want to talk about problem but as an opportunity, what you have learned and potential solutions – still project optimism – and then you ask for help.

Q: How do I get people to agree to receive weekly emails?

You can say: “I have a weekly email I send out to my current investors, would you mind if I put you on it?”. Alternatively, on next email to them, forward your most recent email and say “this is a quick update to the business, if you want to be on these going forward, I can add you”. Lastly, you can forward the email a few hours before your meeting in person, say “just to give additional context”.

Q: What is the typical yield when I ask people for permission to send them weekly emails?

Generally about 50% of your target recipients will be interested in being added

Q: Can we do this monthly rather than weekly?

Month seems too long to wait for updates in the earlier days. A minimum of every two weeks is recommended. It’s a good way to engage your mentors and stakeholders.

Q: What’s the best day and time to send a weekly email?

This should be one of the first or last emails on Mondays. Whatever you do: Do not send it on a Friday because no one will want to read it.

Q: Should we worry about sharing too much too soon to potential investors?

Not at this level of detail. You are well served if you are direct and vulnerable to investors to create a partnership. You can’t just show the good news forever – you need to be real.